It’s been a while in the making, but our IDV+AML feature is now here!

Doc2 has always been focused on making the creation, management, and eSigning of contracts quick and easy for finance professionals. Now, we’re taking things a step further. With the addition of identity verification and AML checks, Doc2 now offers a complete solution for financial compliance workflows.

This powerful new feature means you can handle contracts and compliance in one seamless platform – saving time, reducing risk, and streamlining your workflow.

Who is this for?

How does it work?

Unlike other platforms, our solution accepts UK driving licences and offers a fully integrated experience, meaning you can manage all your eSigning and compliance needs in one place.

What is included in the AML check?

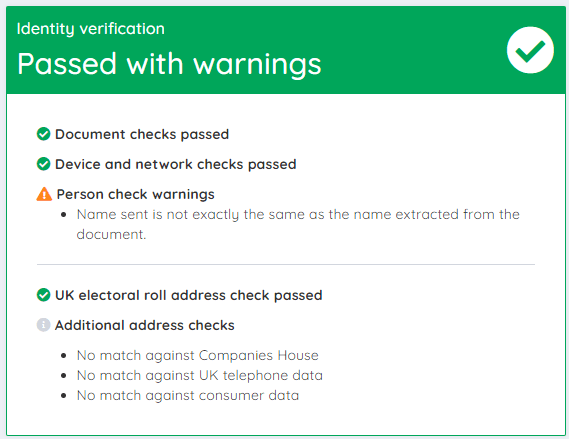

The Anti-Money Laundering (AML) report generated by the IDV+AML feature provides a comprehensive overview of potential risks associated with the individual being checked. The report includes:

- Confirmation of no matches on warnings lists.

- Confirmation of no matches on sanctions lists.

- Confirmation of no matches on fitness and probity lists.

- Confirmation of no matches on politically exposed persons (PEP) lists.

- Confirmation of no matches on adverse media lists.

- Verification against the full UK electoral roll and Experian financial data to provide an address match for KYC purposes.

These results are compiled into a PDF report that is emailed to you and also accessible from the platform, ensuring you have all necessary information to make informed compliance decisions.

Key features of IDV+AML

-

Fully integrated: The IDV+AML feature is fully integrated with document eSigning flows, streamlining your processes.

-

One-stop shop: Manage all your eSigning and compliance needs in one place.

-

Seamless client experience: Clients enjoy a smooth verification process connected directly to eSigning.

-

UK driving licences accepted: Unlike some competitors, we accept UK driving licences.

-

Simple reports: Receive easy-to-understand reports that include checks against sanctions lists and more.

Want to find out more about Doc2?

Still not convinced by IDV+AML? Click the link below to learn even more about how Doc2 can transform your compliance process effortlessly.